What You Need to Know Before You File Your Online Tax Return in Australia

What You Need to Know Before You File Your Online Tax Return in Australia

Blog Article

Simplify Your Finances: Just How to File Your Online Tax Obligation Return in Australia

Filing your on the internet tax obligation return in Australia need not be a complicated task if come close to carefully. Recognizing the intricacies of the tax obligation system and sufficiently preparing your papers are necessary initial actions.

Understanding the Tax Obligation System

To browse the Australian tax obligation system properly, it is vital to realize its fundamental principles and structure. The Australian tax system operates on a self-assessment basis, suggesting taxpayers are in charge of properly reporting their income and determining their tax responsibilities. The primary tax authority, the Australian Taxes Workplace (ATO), manages compliance and imposes tax legislations.

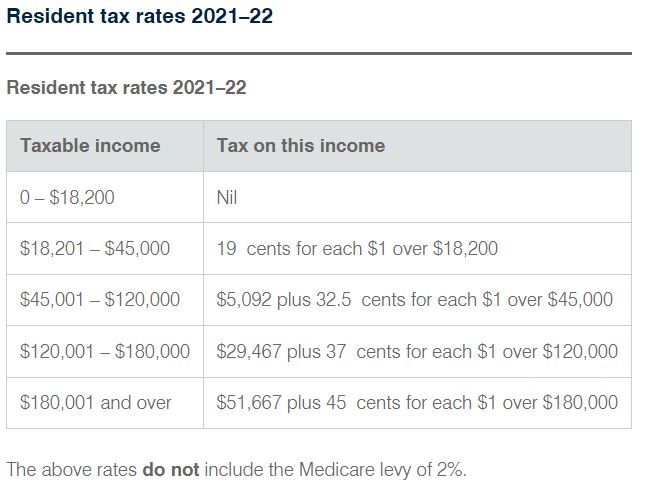

The tax system consists of different elements, consisting of revenue tax, items and services tax (GST), and resources gains tax (CGT), to name a few. Individual earnings tax is dynamic, with rates enhancing as earnings rises, while corporate tax obligation prices differ for small and huge services. Furthermore, tax offsets and reductions are readily available to lower taxed income, permitting more customized tax obligation liabilities based upon individual conditions.

Understanding tax residency is additionally essential, as it determines a person's tax obligation responsibilities. Residents are tired on their around the world revenue, while non-residents are just strained on Australian-sourced revenue. Experience with these principles will empower taxpayers to make educated choices, guaranteeing conformity and potentially maximizing their tax outcomes as they prepare to file their on the internet tax returns.

Readying Your Records

Collecting the required papers is a crucial action in preparing to submit your on-line income tax return in Australia. Appropriate documents not just improves the filing process but also guarantees precision, lessening the danger of mistakes that can cause penalties or hold-ups.

Begin by gathering your income declarations, such as your PAYG settlement summaries from employers, which information your earnings and tax held back. online tax return in Australia. Ensure you have your organization earnings documents and any type of relevant invoices if you are self-employed. Furthermore, gather financial institution statements and documents for any rate of interest earned

Following, compile documents of deductible costs. This may consist of receipts for work-related costs, such as uniforms, travel, and devices, in addition to any educational expenses related to your occupation. If you own residential property, guarantee you have paperwork for rental revenue and connected expenses like repairs or residential or commercial property administration fees.

Do not fail to remember to include other relevant records, such as your health and wellness insurance details, superannuation contributions, and any financial investment revenue statements. By meticulously arranging these papers, you set a strong foundation for a effective and smooth online income tax return process.

Picking an Online Platform

After arranging your paperwork, the following step includes choosing a proper online platform for filing your income tax return. online tax return in Australia. In Australia, a number of trusted systems are available, each offering distinct attributes customized to different taxpayer demands

When choosing an on-line platform, take into consideration the customer interface and simplicity of navigating. A simple design can dramatically enhance your experience, making it much easier to input your info precisely. Additionally, make certain the system is certified with you can look here the Australian Taxation Office (ATO) laws, as this will certainly ensure that your submission satisfies all lawful requirements.

One more critical element is the accessibility of consumer assistance. Systems offering live chat, phone support, or detailed Frequently asked questions can supply valuable support if you come across obstacles during the filing process. In addition, assess the safety actions in area to secure your personal information. Look for systems that make use of security and have a strong privacy policy.

Lastly, think about the costs connected with numerous platforms. While some might supply complimentary services for standard tax obligation returns, others may bill fees for advanced attributes or extra support. Consider these aspects to select the system that straightens finest with your economic circumstance and declaring needs.

Step-by-Step Filing Procedure

The step-by-step filing procedure for your on-line income tax return in Australia is created to improve the submission of your economic info while making certain compliance with ATO guidelines. Started by collecting all necessary files, including your revenue declarations, bank declarations, and any invoices for deductions.

Once you have your documents ready, log in to your selected online system and develop or access your account. Input your individual details, including your Tax obligation Documents Number (TFN) and contact information. Next, enter your income information properly, making sure to consist of all incomes such as salaries, rental revenue, or investment incomes.

After detailing your income, go on to claim qualified deductions. This might include work-related costs, charitable donations, and medical costs. Make sure to assess the ATO standards to optimize your insurance claims.

After making certain whatever is right, submit your tax obligation return electronically. Monitor your account for any updates from the ATO concerning your tax return condition.

Tips for a Smooth Experience

Completing your on the internet tax obligation return can be an uncomplicated procedure with the right preparation and way of thinking. To guarantee a smooth experience, important link begin by collecting all needed files, such as your revenue statements, receipts for deductions, and any other relevant financial records. This organization conserves and minimizes errors time during the filing process.

Next, acquaint yourself with the Australian Tax Office (ATO) site and its on the internet services. Utilize the ATO's resources, consisting of overviews and FAQs, to make clear any type of unpredictabilities prior to you begin. online tax return in Australia. Consider setting up a MyGov account connected to the ATO for a structured declaring experience

In addition, take benefit of the pre-fill capability supplied by the ATO, which automatically inhabits some of your information, decreasing the opportunity of errors. Ensure you verify all entries for precision prior to submission.

Lastly, allow on your own sufficient time to complete the return without sensation hurried. This will certainly assist you preserve focus and reduce anxiety. If difficulties emerge, do not be reluctant to seek advice from a tax expert or utilize the ATO's assistance services. Complying with these pointers can result in a effective and convenient on the internet income tax return experience.

Final Thought

In verdict, filing an online tax obligation return in Australia can be structured through careful prep work and choice of appropriate sources. Eventually, these practices add to a much more reliable tax obligation filing experience, streamlining monetary management and enhancing compliance with tax obligation commitments.

Report this page